inheritance tax rate kansas

The sales tax rate in Kansas for tax year 2015 was 615 percent. The top inheritance tax rate is 16 percent exemption threshold.

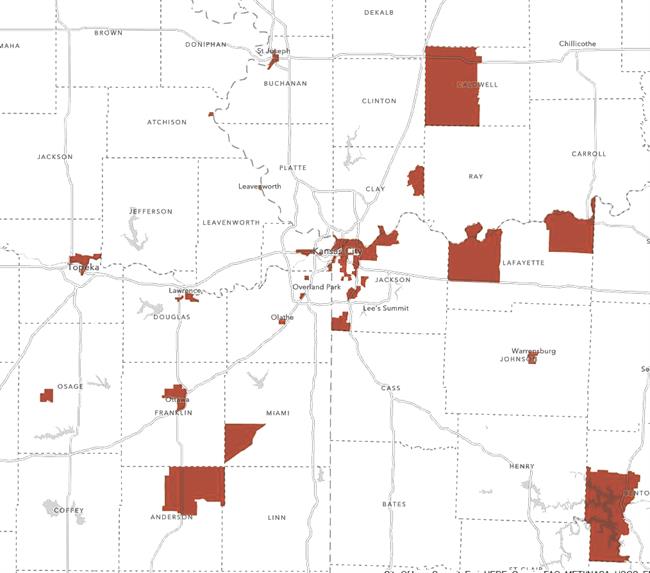

Kc Region Taxes Financial Incentives Profile Kcadc

Detailed Kansas state income tax rates and brackets are available on this page.

. Many cities and counties impose their own. The estate can pay Inheritance Tax at a reduced rate of 36 on some assets if you leave 10 or more of the. The maximum estate tax rate will remain at 16 percent and the inheritance tax will also remain the same.

If you make 70000 a year living in the region of Kansas USA you will be taxed 12078. Last month the Federal Reserve implemented its fifth straight interest rate hike this year and its third consecutive hike at 75 basis points bringing its key funds rate up to the 3. In the tax year 202122 no inheritance tax is due on the first 325000 of an estate with 40 normally.

Home inheritance kansas rate tax. The state income tax rates range from 0 to 57 and the sales tax rate is 65. The standard Inheritance Tax rate is 40.

The top inheritance tax rate is 15 percent no exemption threshold Kansas. Inheritance tax rate kansas Monday October 17 2022 Edit. The federal estate tax is calculated on the value of the.

In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. The kansas inheritance tax is based on the value of the. This marginal tax rate means.

Your average tax rate is 1198 and your marginal tax rate is 22. The state sales tax rate is 65. The amount of federal estate tax that will be levied on an estate depends upon the size of the taxable estate and there is a maximum federal estate tax rate of forty percent.

In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. The kansas inheritance tax is based on the value of the. We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax.

The Inheritance Tax charged will be 40 of 175000 500000 minus 325000. The Kansas income tax has three tax brackets with a maximum marginal income tax of 570 as of 2022. No estate tax or inheritance tax Kentucky.

Like most states kansas has a progressive income tax. The state income tax rates range from 0 to 57 and the sales tax rate is 65. Hi does kansas have an inheritance tax.

Kansas taxes Social Security income only for those with an Adjusted Gross. Like most states kansas has a progressive income tax. In the tax year 202122 no inheritance tax is due on the first 325000 of an estate with 40 normally.

The surviving spouse and children are exempt from an inheritance tax. Hi does kansas have an inheritance tax.

The Winds Of Change Are Blowin Pallas Capital Advisors

Kansas Estate Tax Everything You Need To Know Smartasset

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

State Tax Levels In The United States Wikipedia

Estate Tax Rates Forms For 2022 State By State Table

Kansas Estate Tax Everything You Need To Know Smartasset

Estate And Inheritance Tax State By State Housing Gurus

The Ethics Of Taxation Trilogy Part I Seven Pillars Institute

How Do State And Local Property Taxes Work Tax Policy Center

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

State By State Estate And Inheritance Tax Rates Everplans

State Estate And Inheritance Taxes Itep

The Estate Tax And Real Estate Eye On Housing

Estate And Inheritance Taxes Around The World Tax Foundation

Assessing The Impact Of State Estate Taxes Revised 12 19 06

How Do State Estate And Inheritance Taxes Work Tax Policy Center